How To Validate A Builders ‘Stat Dec’

Can You Pick A False Stat Dec From A True One?

Despite being one of the core requirements for the release of funds by developers and lenders (not to mention, a legal document), the ‘stat dec’ has become something of a ‘tick & flick’ item in practice, carrying extraordinarily little weight. But this is not without reason; the lived experience suggests that receiving a signed ‘stat dec’ offers no assurance that anyone has actually been paid.

With the likelihood of prosecution for submitting a false or misleading ‘stat dec’ being extremely low (amongst the multitude of builder insolvencies and unpaid creditors, we’re aware of one case where an individual was pursued for a fraudulent declaration), all that’s standing between a distressed builder and the payment they need is a little piece of paper that no one can check anyway.

Unsurprisingly, most developers will tell you that a ‘stat dec’ is essentially worthless, but they are forced to accept it at face value and release payment with no other real alternative.

Trust But Verify: Never Release Another Progress Payment Without Being Sure.

Although the ‘stat dec’ process is clearly flawed, we don’t expect it to be removed as a requirement any time soon. But you no longer have to act under the assumption that they’re all true and wait for the day you’re proven wrong; we’re offering developers and lenders a way to check every single payment.

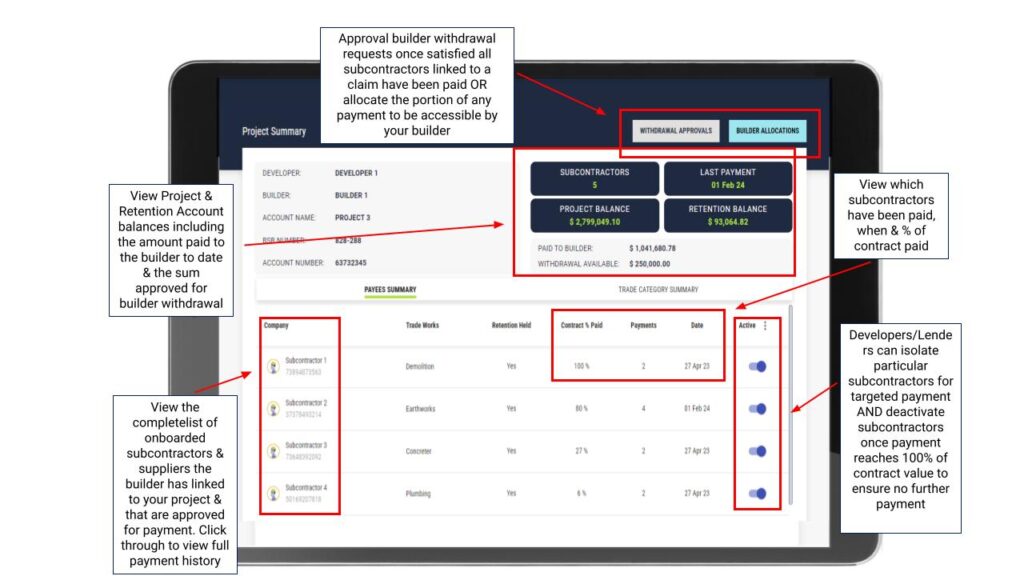

IPEX not only ‘ring-fences’ funds to a specific project, preventing your builder from using subcontractor entitlements to cash flow another project (a key motive behind falsified declarations), it also allows developers and lenders to verify that everyone linked to the previous claim has been paid before approving the next payment.

Typically, developers will login to IPEX with each new progress claim and perform a quick check:

- Did each subcontractor & supplier linked to the last claim receive payment?

- Does the amount received by each subcontractor/supplier line up with work completed – depending on your access level, this can be in the form of percentage each has been paid against their contract value (standard view) or precise dollar amounts (open book).

If there’s any discrepancy between expected and actual, you will identify it immediately and can take action – whether that is simply seeking an explanation as to why a particular subcontractor has not been paid or, in the case of more serious/repeated breaches, enliven protective clauses and take control of the project account.

IPEX Gives Teeth To Your ‘Payment Default’ Rights & Protections.

All contracts contain a range of measures designed to protect the developer & lender, allowing them to ‘step in’ should a ‘payment default’ event occur. In practice, these have proven to be largely ineffective – if you don’t know that your builder has stopped paying subcontractors, how can you act?

IPEX supports all standard D&C contract rights and protections with one key difference, IPEX actively helps you to identify a payment default event and ‘step in’ far earlier; if your builder submits a fraudulent stat dec claiming they’ve paid someone when they haven’t, you can now see it and take action to protect your project before the builder enters administration.

The ‘Stat Dec’ Process Leaves You Exposed; There Is A Simple Way To Reduce Your Risk.

There is a way to know subcontractors have been paid before approving progress claims (without resorting to paying them directly); it’s called IPEX. Whilst IPEX can’t prevent your builder from running into cash flow issues, it does offer developers & lenders a range of legal protections and practical controls in case they do.

So, keep requesting those ‘stat decs’, but confirm what they say before releasing that next progress payment!

To find out if IPEX can be implemented on your next project, get in touch.