Most lenders have stepped up financial due diligence in response to widespread builder cashflow pressures and heightened insolvency risk. Unfortunately, it’s no guarantee they (or their investors) will be spared – it’s near on impossible to verify a builders’ true financial position through upfront due diligence alone.

And even if you are satisfied with your builders’ current financial position, no DD check can predict the financial impact of new contracts they may sign throughout your build; due diligence stops just as delivery risk begins.

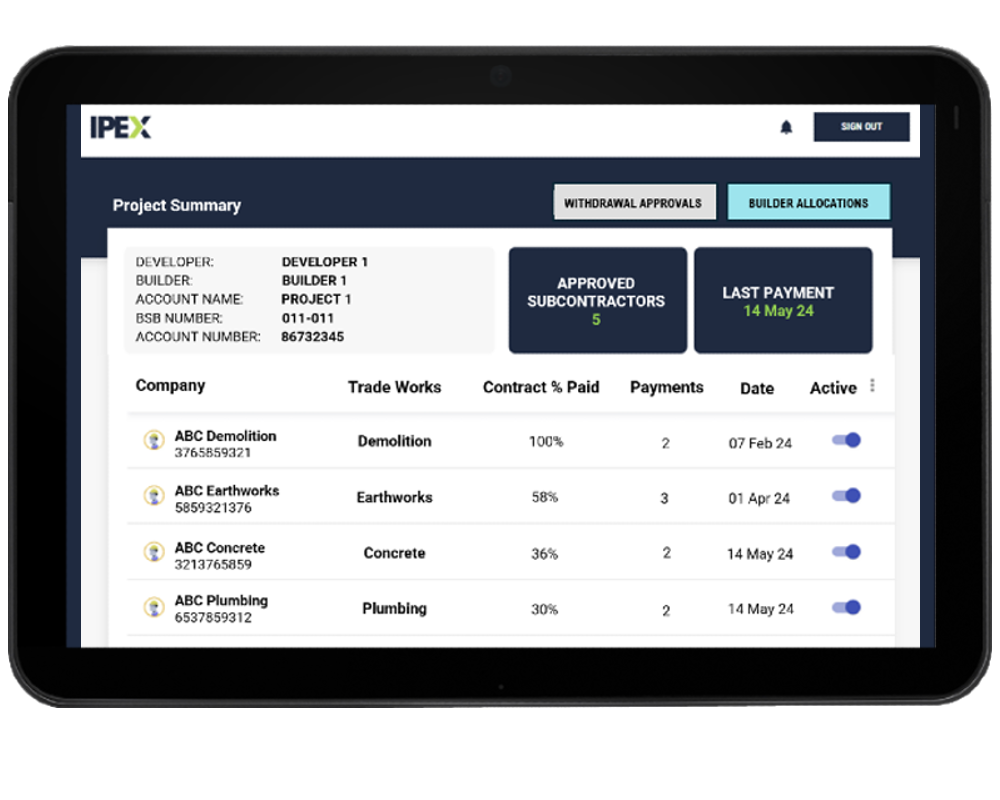

IPEX is an online payment platform that places practical limits on how a builder can use project funds. Builders can access payment for their preliminaries, margin & direct costs, but the balance of each progress payment is set aside and off limits – these funds can only be used to pay subcontractors and suppliers linked to the project.

Rather than relying solely on a ‘stat dec’, IPEX allows the lender to verify that those linked to previous claims have been paid before releasing further payment.

Importantly, IPEX also helps to validate builder financial due diligence outcomes: if your builder truly has the financial capacity to complete existing contractual commitments, they should not need to divert funds from your project!

There is NO cost to lenders; IPEX is paid for by the developer.

‘Test’ builder due diligence outcomes to find ‘honest’ builders.

Stop payments from being used to cashflow other projects.

Validate ‘stat decs’ to confirm subcontractor payments.

Act on ‘step in’ rights before your builder goes under.

Protect funds already paid to builder in the event of insolvency.

KYC/AML checks of all subcontractors & suppliers.

No change to builder process & no impact to builder payment.

Whilst lenders already demand additional oversight under the developer-builder model, these checks are largely manual and rely on information that is sourced from the borrower – not ideal when one of the primary risks to the lender is the potential for the developer-builder’ to divert funds to other projects.

IPEX transparency and places practical limits on how the borrower can use project funds largely solves the financial oversight problem for lenders.

In addition, as IPEX removes the need for manual oversight checks by the lender, it also removes the admin associated with ‘proving’ compliance from the borrower – the lender can already see that the right people have been paid.

‘TEST’ BUILDER FINANCIAL DUE DILIGENCE RESULTS TO FIND THE ‘HONEST’ BUILDERS

Due diligence in its current form requires the developer/lender to satisfy themselves of a builders’ ability to meet existing contractual obligations. If the information they are basing this decision on is out of date, incomplete or fraudulent, they bear the consequences.

IPEX shifts the onus for any due diligence ‘gaps’ onto the builder; those willing to accept the condition of ‘ring-fenced’ funds are essentially ‘proving’ their financial status; those that have misrepresented their true position will fight IPEX inclusion & likely withdraw.

PREVENT PAYMENTS BEING USED TO CASHFLOW OTHER PROJECTS & ACT ON ‘STEP IN’ RIGHTS EARLY

IPEX adds practical controls that prevent a builder from using progress payments to cash flow another project, even if they’re in extreme financial distress. Builders can access payment for their preliminaries, margin & any direct costs, but funds equal to the value of works performed by subcontractors are set aside & off limits.

IPEX also allows developers to confirm every subcontractor & supplier payment. If your builder submits a ‘stat dec’ claiming to have paid someone they haven’t, you can identify it immediately & take action before approving the next claim. In the case of more serious/repeated breaches, you’ll have the information you need to act before your builder enters administration.

PROTECT FUNDS ALREADY PAID TO THE BUILDER IN AN INSOLVENCY EVENT

Should a ‘payment default’ event occur before completion of an IPEX protected project, the impact to developers & lenders is minimised as:

PREVENTION FROM DAY 1:

PROTECT AGAINST FUTURE BUILDERS’ CASHFLOW ISSUES

MID-PROJECT IMPLEMENTATION:

GUIDE ‘TROUBLED’ PROJECTS TO COMPLETION SAFELY

* Standard developer portal view shows payment as % of contract value. Open book developer portal view shows subcontract/payment values.