IPEX is an online payment platform that secures funds intended for a project, protecting developers and Sub-Contractors in the event of Builder insolvency.

IPEX software integrates with a dedicated construction project bank account to ensure that progress payments are used only to pay approved Sub-Contractors & Suppliers linked to that specific project. IPEX provides Developers with visibility over who has been paid & when, without sharing a Builders’ commercially sensitive information.

Whilst IPEX protects Developer & Sub-Contractor payments, it also helps financially secure Builders to validate their money management practices, differentiating their bid from competitors in the process.

Whether the result of underquoting to win a contract or simply having cost of materials/labour rise unexpectedly on a fixed price contract, many Builders are finding themselves in a position where they are no longer able to complete projects for the amount agreed, creating a shortfall that needs to be covered.

When progress payments for multiple projects are being deposited into the one account, it’s practically impossible to avoid using funds intended for one project to pay bills linked to another. This ‘swings & roundabouts’ approach has had fewer consequences in the past however, carries extreme risk in today’s market; if even a single project runs into trouble, the resultant shortfall is likely being covered with another Developers money.

Project shortfalls can become so large that ‘buying’ a new contract is the only remaining option; submitting an extremely low margin bid with the sole intention of injecting cash into the business. The cut-rate might be appealing but comes at huge risk to the Developer with early progress payments almost certain to be used to bring another project to completion. Whilst you may award your projects at sensible margins, you are exposed if ANY project linked to your Builder runs into financial trouble.

The recent wave of highly publicised Builder insolvencies has unfairly (albeit understandably) cast doubt over all Builders.

This has led to ever increasing scrutiny on Builder finances but ultimately, Developers know that they can never be sure.

Whilst there are many Builders who are factoring foreseeable risk into margins & managing client funds appropriately, the problem for Developers (& these ‘prudent’ Builders) is, it’s hard to know who they are!

Regardless of the number of successful projects you’ve completed together, without transparency around the progress claim/payment process, you can never be sure whether your Builder is managing your money responsibly or you’ve just ‘got lucky’.

Project Trust Accounts are held with Macquarie Bank.

As the Developer or Lender, you can mandate the use of IPEX on your next project by including IPEX as a clause within the Builder contract.

Invite your Builder to join the ‘IPEX Ready’ Builder Directory.

Customer stories and feedback.

Download resources and additional information.

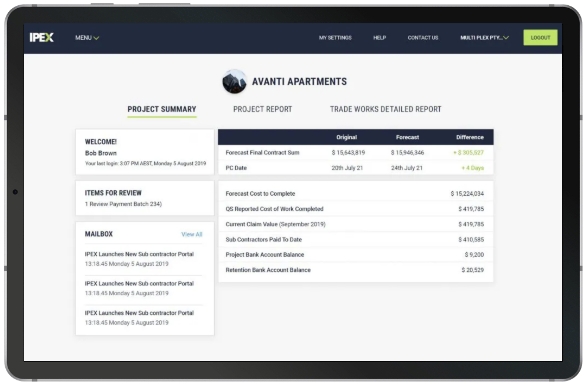

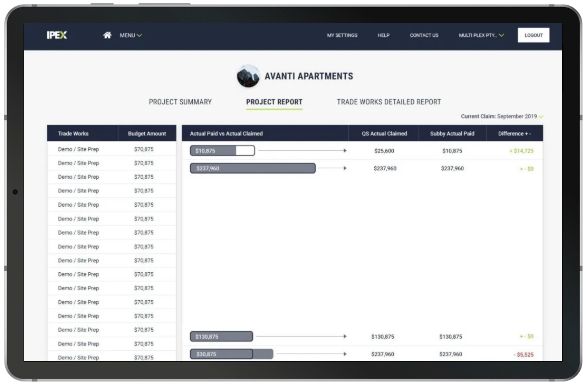

Developers can use the IPEX portal to check the status of progress payment distribution. Log in to view a summary of payments made including which Sub-Contractors & Suppliers have been paid & when plus the percentage of total contract value that has been paid.

As a construction project Developer/Financier, it’s important to know that your investment is being handled responsibly & funds are being used for their intended purpose, payment of Suppliers & Sub-Contractors. It’s standard practice for Builders to manage multiple projects from a single account, which means your progress payments are being thrown into the pot & are almost certainly being used to pay bills linked to other projects. When a Builder becomes insolvent, it can be extremely difficult to track down where this money has gone & even harder to get it back. The resultant delays can also significantly increase holding costs to the Developer.

IPEX helps to minimise risk by providing Developers with complete visibility of their project’s finances in real-time, delivering the insights they need to make informed decisions quickly. Additionally, IPEX ensures that the project funds can only be distributed to verified subcontractors and suppliers on your project, ring-fencing your project and protecting it from misuse of funds. With IPEX backing your build, you get the peace of mind of knowing that your approved Builder is adhering to responsible project fund distribution, safe in the knowledge that your Builder cannot use your project funds to pay bills for any other projects or, for their own operational expenses.

Developers will pay a small fee based on total construction value to protect each project. Awarded Sub-Contractors also pay a small fee for the KYC/AML checking & onboarding process & IPEX software protections, all of which reduce their risk of non-payment.

As a construction project Developer/Financier, it’s important to know that your investment is being handled responsibly & funds are being used for their intended purpose, payment of Suppliers & Sub-Contractors. It’s standard practice for Builders to manage multiple projects from a single account, which means your progress payments are being thrown into the pot & are almost certainly being used to pay bills linked to other projects. For many Builders, the ability to move money between projects is beneficial however, this activity poses significant risk to the Developer/Lenders investment. This is why we are seeing more & more Developers implement IPEX as a way of gaining control over their investment, with real-time reports detailing exactly how money is being spent while minimising risk.

IPEX gives Developers the confidence that their investment is secure, allowing them to focus on what matters: making their vision a reality. With IPEX, financial security is just one less thing to worry about.

It’s standard practice for Builders to manage multiple projects from a single account, which means your progress payments are being thrown into the pot & are almost certainly being used to pay bills linked to other projects. With IPEX, your project’s funds are held in a secure project bank account, which can only be accessed by verified account holders and distributed to verified subcontractors and suppliers. You’ll have complete visibility into how your funds are being spent on the project, so you can rest assured your investment is managed responsibly.

IPEX puts you in control of your investment, with real-time reports detailing exactly how your money is being spent, helping increase project transparency and minimise risk.

The terms ‘Project Bank Account’ & ‘Project Trust Account’ are often used interchangeably and typically refer to the same type of account.

In Queensland, the QBCC has legislated the use of Project Trust Accounts. You can view the Building Industry Fairness (Security of Payment) Act here: https://www.legislation.qld.gov.au/view/html/inforce/current/act-2017-043

NSW & WA also have rules in place for Builder compliance re: Project Trust/Bank Accounts & Retention Accounts:

IPEX is a tool that, if used correctly, will assist your Builders to meet their obligations under the various compliance requirements in the construction industry.

As the developer or financier, you can mandate the use of an IPEX Project Trust Account on your next project by including IPEX as a clause within the Builder contract.

Builders can also choose to implement IPEX; some Builders are proactively introducing IPEX to Developer clients as a way of differentiating their offer, putting them into prime position to win the contract.

Not knowing where the money for your project is going can be incredibly stressful, even more so when juggling multiple projects. With IPEX, real-time reporting gives you complete visibility of your project’s finances, delivering the insights you need to make informed decisions quickly. IPEX provides end-to-end transparency across the project supply chain, so you can see the big picture, make more informed decisions and know your money is being used as intended. With greater transparency comes trust, improved relationships, and ultimately, more successful projects.

All Sub-Contractors & Suppliers submitted via the Builder are onboarded via fully compliant KYC (Know Your Client) & AML (Anti-Money Laundering) protocols, flagging unregistered/deregistered companies as well as those potentially ‘related’ to the Builder.

Whilst some Developers are mandating the use of IPEX as a condition of winning the contract, others are communicating their desire to use IPEX with their Builder, aiming to have them understand and accept these terms. Some Developers are also acknowledging the additional protection IPEX provides them by being more flexible on other processes relating to Builder cash flow including reducing upfront security requirements & the potential release of funds in advance for long lead time material deposits.

The primary difference between the IPEX offering & standard Project Trust/Project Bank Accounts is that IPEX prevents the movement of funds out of the account for any reason other than to pay approved Sub-Contractors & Suppliers. Whilst legislation mandating the use of Project Trust Accounts is designed to perform a similar function, they do so largely via the threat of fines & other penalties rather than actually preventing the movement of funds from occurring.

A Developer will still implement IPEX in states/territories where Project Trust Accounts/Project Bank Accounts are already legislated to protect their investment. The primary difference between the IPEX offering & standard Project Trust/Project Bank Accounts is that IPEX prevents the movement of funds out of the account for any reason other than to pay approved Sub-Contractors & Suppliers. Whilst legislation mandating the use of Project Trust Accounts is designed to perform a similar function, they do so largely via the threat of fines & other penalties rather than actually preventing the movement of funds from occurring. Put simply, standard Project Trust Accounts do not provide the security of funds that IPEX does.

IPEX runs each Sub-Contractor registering to receive payments through a series of checks as part of the onboarding process. These checks are performed to help prevent the incidence of fraud. Checks include

The Developer will be notified of any item that raises doubt re: status of a Sub-Contractor entity.

During normal operation of the Project Trust Account process, the Builder is appointed trustee of the project trust account with associated Sub-Contractors, Suppliers & the Builder themselves being beneficiaries. Under IPEX terms, should the trustee become insolvent or otherwise fail to fulfill its obligations in accordance with set terms, the Developer has the right to remove the Builder as trustee & appoint themselves (or a nominee of the Developer). The new trustee is then entitled to make payment directly to beneficiaries.

The Building & Construction Industry Security Of Payments Act legislation that applies is determined by which state the construction project for which the works were carried out, or for which related goods and services were provided, is located. Use of the IPEX payment portal does not change one’s obligations to adhere to the Security of Payment Act however, IPEX processes are complimentary to it. If you have any questions about meeting your obligations under the Security of Payments Act, please seek legal advice.

IPEX is working with NCC Group, a global cyber security organisation, to ensure our technical solutions, processes, procedures and staff are at an appropriate level of cyber maturity. We will continue to enhance our privacy program to ensure our clients & customers receive the highest level of end-to-end security across the full data lifecycle, assured that IPEX is embedding privacy by design and default to meet and exceed any privacy obligations.

To learn more about NCC Group, please visit: https://www.nccgroup.com/au/